New CGT Rules for Brits

When selling UK properties, Britons that live overseas are now subject to Capital Gains Tax, but you can minimise the impact.

April 5th marked a new tax year in Britain, and the introduction of new legislation which taxes any gains made on residential property sold by all of those living outside the UK. Up until this change, it had been possible for expats to sell their UK property tax-free before returning home.

In order to avoid being stung by a hefty CGT bill in the future, expats are being advised to act now. The profit will be calculated on the increase in the property’s value from April 5th 2015, so you can still reduce the size of your future bill if you take action.

You need to get the property independently valued by a qualified chartered surveyor or local estate agent as close to this date as possible, even if you have no plans to sell it. Two valuations are a good idea, or even three if they differ wildly. Remember that a surveyor will probably charge a fee and an estate agent is often free.

Keep the written valuations for your records in case the taxman requires them after the property is sold. A non-UK resident can attempt to obtain a retrospective valuation if need be, but it will be a far more complex and costly solution.

When you do eventually sell your property, you need to fill out a Non-Resident Capital Gains Tax (NRCGT) return and tell HM Revenue and Customs within 30 days of completing the sale, whether you have made a profit or not. For more information on NRCGT please visit HMRC.

The amount of tax that you pay depends on whether you are a basic rate taxpayer or not. You qualify as a basic rate taxpayer if you are earning up to £31,785 (2015/16) and you will be liable for 18% on any gain. Higher and additional rate taxpayers will pay 28% CGT.

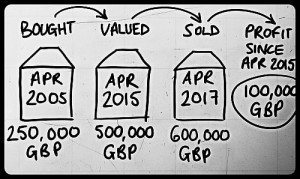

Example:

If Joe Bloggs bought a property in 2005 for £250,000, which was valued in April 2015 for £500,000, but then wasn’t sold until 2017 for £600,000, Mr. Bloggs would only have to pay CGT on the £100,000 it had increased in price since April 2015.

As a basic rate taxpayer, he would therefore have to pay £18,000 minus his annual CGT exemption (currently £11,000) and expenses. If he was in the higher tax band, he would have to pay £28,000 minus his CGT allowance and expenses. It is also worth noting that if the property is held in a trust, the trustees would also have a CGT exemption of £5,500.

In order for expats to pay no CGT, their property would have to be classed as their Principal Private Residence (PPR) for tax purposes. This could be done by them (or their spouse) living in the UK home for at least 90 days a year. Alternatively, they can return to the UK and live in the property before selling, which would provide partial PPR relief. Please be advised that calculating this relief is complex and depends on a number of factors. It is strongly advised that you consult a expat tax specialist, if you need more information.

British Expats, Capital Gains Tax, Featured, Property, UK, UK property

Comments RSS Feed